Trump Says Tariff Revenues Surging, But Families Won’t See Checks Yet – Financial Freedom Countdown

President Donald Trump said Tuesday that while his administration’s priority remains paying down the national debt, there is now a “concept” of using surging tariff revenues to deliver rebate checks to Americans.

Speaking during a cabinet meeting, Trump said, “We have a lot of money coming in. It’s coming in tremendous numbers. There’s a concept of making a dividend to the people of this country who have paid a lot of taxes and got nothing for it.”

“There’s a possibility. Primarily we want to pay down debt, but there’s a possibility that we take a piece of it and make a dividend to the people.”

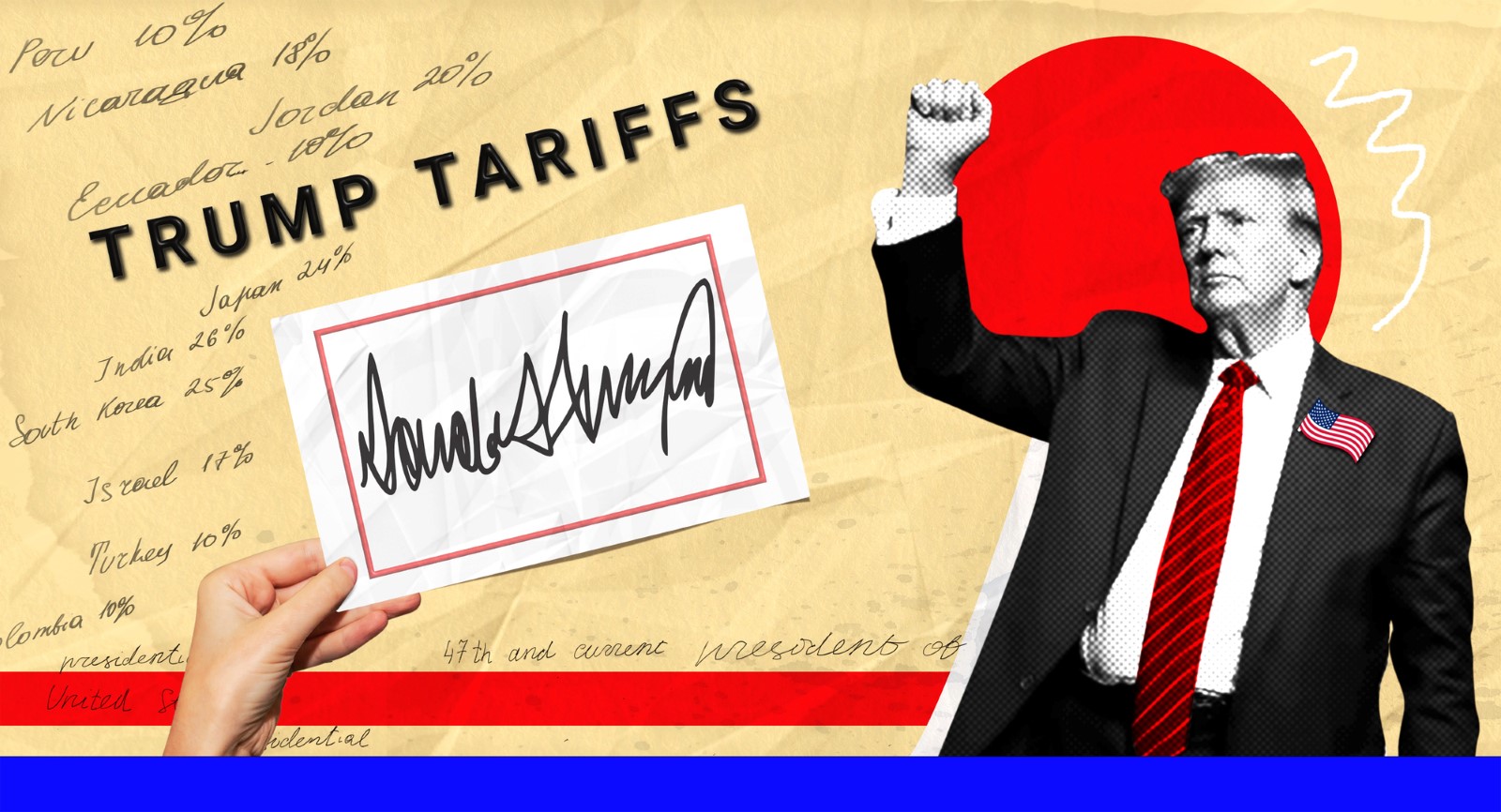

Historic Tariff Revenue in 2025

Customs duties collected under Trump’s tariffs have reached historic levels this year.

As of late July, collections totaled $150 billion, including a $28 billion haul in July alone; the highest monthly total of 2025.

Fiscal year-to-date customs revenue has climbed to $108 billion, nearly 95% higher than the same period in 2024.

Treasury Sees Billions More Ahead

Last Tuesday, speaking on CNBC’s Squawk Box, Treasury Secretary Scott Bessent revealed that his earlier $300 billion estimate will be revised “substantially upward,” though he declined to provide an exact figure.

Today, Bessent has projected revenues could exceed $500 billion annually and potentially approach $1 trillion if collections continue at their current pace.

Bessent, however, has consistently emphasized that debt reduction will come before any consideration of rebate checks.

Both Trump and Bessent have framed the growing revenue stream as a tool to lower the federal deficit and begin reducing the $37 trillion national debt.

Hawley Pushes the “American Worker Rebate Act”

At the center of the discussion is Senator Josh Hawley of Missouri, who introduced the American Worker Rebate Act in late July.

His plan would redirect tariff revenues into checks for American households. Each adult and dependent child would receive at least $600; meaning a family of four could get $2,400.

The rebates would phase down for higher earners, with income limits set at $75,000 for individuals.

Hawley argues that after “four years of Biden’s failed economic policies,” families deserve a direct boost from Trump’s tariff windfall.

Who Qualifies For Tariff Rebate Checks

To qualify, you must be an eligible individual, meaning:

U.S. resident

Not claimed as a dependent on another return

Not a nonresident alien

Not an estate or trust

Each person must also have a valid SSN.

The bill was read twice in the Senate on July 28 before being referred to the Finance Committee. As of this week, neither the House nor Senate has taken further action.

Paying Down Debt Before Sharing the Money

Despite mounting calls for household relief, Bessent stressed that the administration’s top priority is tackling the federal deficit. “We’re going to bring down the deficit-to-GDP, we’ll start paying down debt, and then at that point that can be used as an offset to the American people,” he said.

Why the Focus on Debt Matters

The U.S. debt has ballooned past $37 trillion, raising concerns from credit agencies and investors.

Bessent noted that S&P Global recently affirmed America’s AA+ credit rating, but warned that high debt levels remain a long-term risk if not brought under control.

Rising Revenues Could Mean Bigger Rebates

One notable provision in the proposal is that rebates could increase if tariff revenues come in higher than projected.

With Bessent signaling a “substantial” upward revision to the $300 billion estimate, the potential payouts could be significantly larger if the measure ever advances.

Treasury Says Debt Comes First

Still, Bessent made clear that rebates remain secondary to fiscal discipline.

While the administration has not ruled out future relief, he emphasized that paying down the debt is the immediate priority.

For now, that means households will not see rebate checks in the near term.

$150 Billion Already Collected Since April

According to Treasury Department data, the U.S. has collected about $150 billion in tariff revenue since April, when the latest round of levies took effect.

The pace of collections is one reason the administration believes it can move quickly on deficit reduction.

Political Debate Over Tariff Windfall

Senator Rand Paul of Kentucky said last month that given the size of the debt, such an idea was “ridiculous.”

“We’re gonna basically borrow money to send it to the American people? There is no rebate if there’s no money,” Paul said. “I mean, it’s the dumbest idea I’ve ever heard.”

The diverging views between Congress and the Treasury highlight a growing debate in Washington: should tariff revenues be used to shore up the nation’s finances, or should Americans see the money directly?

A Balancing Act Ahead

The administration now faces a difficult balancing act: celebrating record tariff revenues while managing the political pressure for direct cash relief.

According to Treasury data, tariff collections have already brought in more than $150 billion this year, strengthening the government’s balance sheet.

For now, those funds are earmarked for debt reduction, leaving the prospect of rebate checks uncertain and politically contested.

Trump is making it clear that debt reduction remains the first order of business while acknowledging the “concept” of a tariff rebate check for Americans.

Like Financial Freedom Countdown content? Be sure to follow us!

This month marked the 90th anniversary of Social Security, a program that has kept millions of Americans out of poverty for generations. But while the monthly checks remain a lifeline for retirees, new warnings from the program’s trustees show that drastic changes could be coming within less than a decade; unless Congress acts soon.

Social Security Turns 90 Today; But Trustees Warn Your Benefits May Not Survive to 100

With the Social Security trust funds projected to run out in less than a decade, Sens. Bill Cassidy (R-La.) and Tim Kaine (D-Va.) are pitching a bold plan. Their idea: invest $1.5 trillion over five years into a separate investment fund, give it 70 years to grow, and use the returns to keep benefits flowing.

Bold $1.5 Trillion Plan Promises to Rescue Social Security As Experts Warn of Big Risks

The Social Security Administration (SSA) has announced that paper checks will no longer be issued starting September 30, 2025, in a major modernization move led by the Trump administration. This change is part of a broader government effort to reduce fraud, improve efficiency, and save taxpayer dollars.

New Trump Order Lets 401(k) Hold Crypto and Private Equity. Is It a Retirement Revolution or a Trap?

In a move that could reshape retirement planning for millions, President Donald Trump signed an executive order on Thursday allowing alternative investments like private equity, cryptocurrencies, and real estate to be included in 401(k) plans. The change marks a dramatic shift in policy, potentially opening the $12.2 trillion retirement savings market to high-growth assets previously off-limits to everyday Americans.

New Trump Order Lets 401(k) Hold Crypto and Private Equity. Is It a Retirement Revolution or a Trap?

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.